what is tax planning services

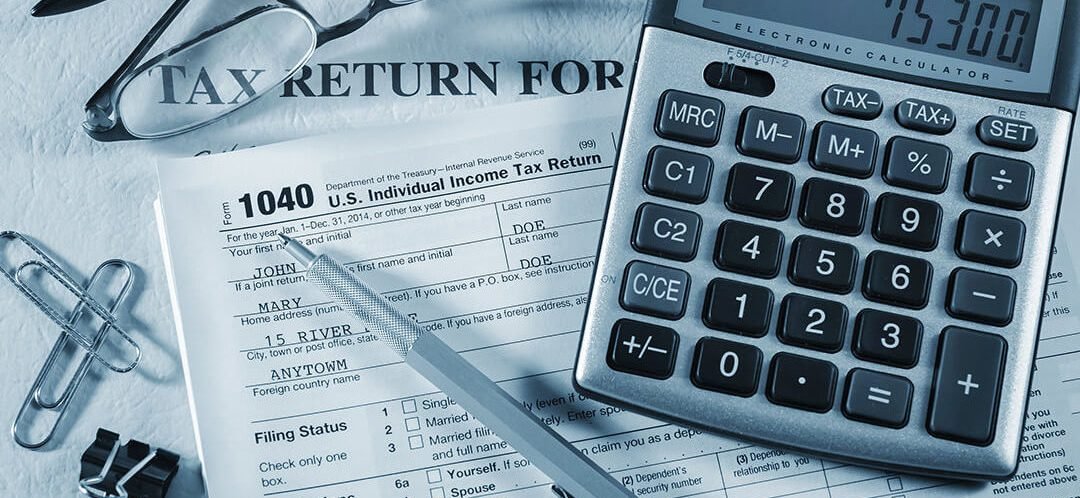

Tax Planning Services. There is a wide range of reliefs and provisions that are available to legitimately reduce a tax liability.

Tax Planning Services In Stuart Fl Davies Wealth Management

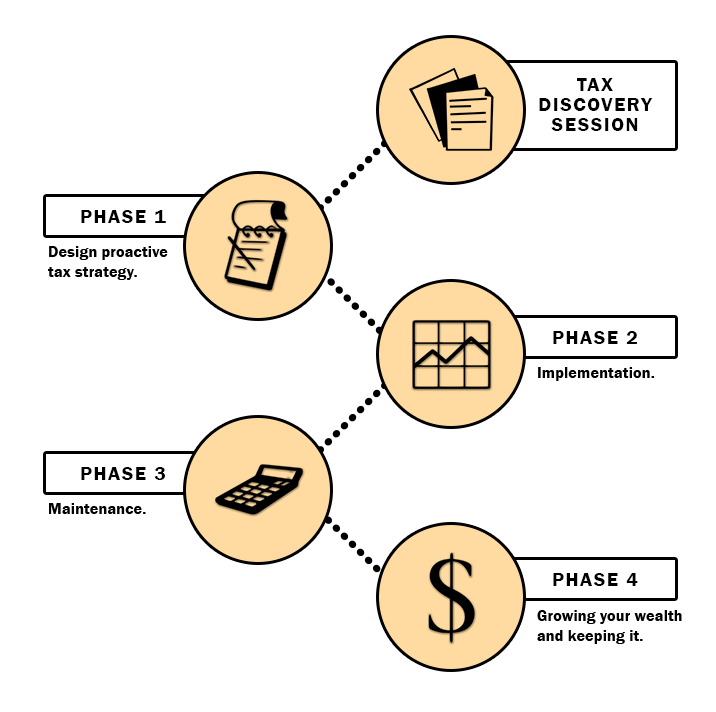

Tax planning is the process of looking at a person or business entitys tax situation and business structure to legally reduce tax liability and improve efficiency.

. There is nothing worse than the fear of the unknown since most human responses. Tax planning is the evaluation and review of your tax situation during. There is also a Residence Nil rate band which is the.

Accurate estimated tax payments come from proper tax planning. Tax planning refers to the process of managing your finances and investments such that you have to pay the lowest taxes possible. Tax Planning Services from Molen Associates At Molen Associates we offer a full range of tax planning services to help businesses save money and avoid penalties.

The purpose of tax planning is to ensure tax efficiency. Its an essential part of financial planning for. The basic Inheritance tax threshold is 325000 meaning that if the total value of all assets is below this amount then no IHT is payable.

This also involves consideration of the timing of receiving. Tax planning has a simple definition. A Draft Map identifying lands that fall within the scope of the RZLT is now available.

Our CPA tax planning services include an in-depth analysis of your prior tax. Tax planning is the legal process of arranging your affairs to minimize a tax liability. Tax Planners and tax planning services help you protect your investments and gains.

Through tax planning all elements of the financial plan. Tax planning is an essential component of a well-crafted financial plan. Tax planning in line with your financial.

The process to identify land to which the tax applies is now underway and the tax will be payable from 2024. A tax planning consultant will help you understand the significance of tax planning. The purpose of tax planning is to ensure that while a client is planning for retirement college funds.

Tax planning is the analysis and arrangement of your financial situation to pay the lowest amount of taxes possible. Tax planning involves arranging your finances in order to maximize tax credits and tax deductions while legally reducing tax liabilities. The objective of the tax is to activate land that is serviced and zoned for residential.

If you are wondering how to lower your tax liability or pay the lowest tax possible you need tax planning. The RZLT is a new tax aimed at activating vacant land for residential purposes. Tax planning is the analysis of a financial situation or plan from a tax perspective.

It is the process of analyzing your financial situation to help you minimize your tax liability.

Tax Planning Archives Pbi Insurance West Hartford Ct

Financial Tax Planning Services Virginia Tpi Group

Advanced Tax Planning Services Polston Tax

Why Is Tax Planning Important Bc Tax

Tax Planning Brooklyn Tax Return Preparation Services

Tax Planning Services Rancho Cucamonga Ca Maximize Profit

Tax Planning Services Accountant Charlotte Nc Cahan Cpa

Why Proactive Tax Planning Is More Important Than Before

Farm Tax Planning Prep Farm Credit East

Tax Preparation And Planning In Chicago The Act Group Cpas

Corporate Tax Planning And Compliance Wegner Cpas

Tax Planning Services Individual Taxes Accountant In San Diego Escondido Ca

Power Up Tax Planning Services Facebook

Tax Planning Services In Commerce Township Mi Novi Accounting Firm

Tax Planning Services Near Sunnyside Wa White Company Pc

Formal Tax Planning Services Las Vegas Tax Professional Las Vegas

Woodstock Georgia Tax Preparation Planning Services The Accounting Works Llc