ending work in process inventory calculation

However an inventory buffer is needed in front of any constrained workstations in the production area to ensure an even flow of goods. Following that you will be able to adjust your Inventory accounting with different parameters.

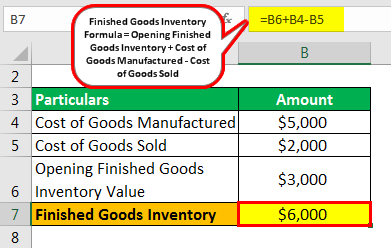

Finished Goods Inventory How To Calculate Finished Goods Inventory

471 costs rather.

. It leaves the outstanding inventory of the process at 20000. LIFO last in first out inventory. How to calculate days inventory outstanding.

Calculate the cost of average inventory by adding together the beginning inventory and ending inventory balances for a single month and divide by two. Since the first purchased units are sold first the value of the seven units sold at the unit cost of the first units purchases and the balance of 3 units which is the ending Inventory cost is as follows. Their ending inventory is 8500 which shows there is an overstatement of 500 in the final inventory amount.

The inventory is considered to be a hazardous item in the balance sheet. A simple formula to calculate the cost of goods sold is to start with your beginning inventory value add any purchases or other costs and subtract your ending inventory value. Retail Inventory Method.

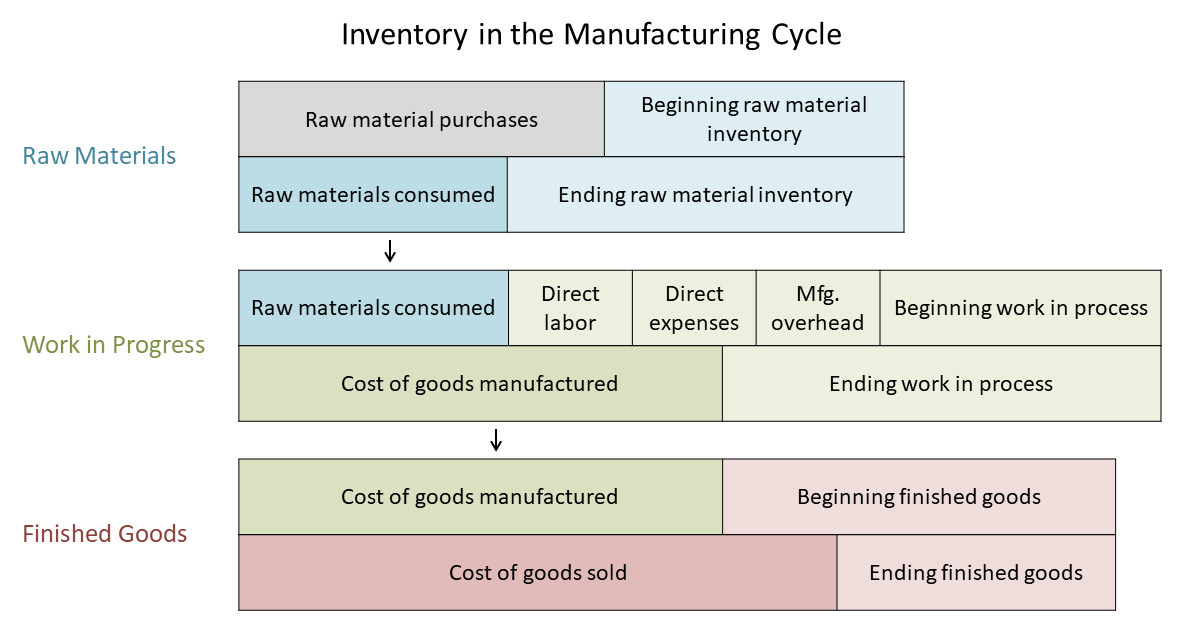

In March 2022 inflation-adjusted constant dollar private wages and salaries were 1223 at the 10th wage percentile 2012 at the 50th median wage percentile and. Process costing also relies on calculations of equivalent units which are determined by assigning costs to unfinished goods at the start or end of an accounting period. Raw material work-in-progress also known as work-in-process and finished goods.

INVENTORY TAX CREDITThe inventory tax credit increases to 100 percent of the ad valorem taxes timely paid for property described in KRS 1320201e or KRS 132099 for taxable years beginning on or after January 1 2021. You can enter a maximum of 5 lot hold codes from UDC table 41L. Inventory in the Balance Sheet.

Companies include the value of this work in process on balance sheets. It typically involves three types of inventory. 263A costs must be allocated to ending inventory using either a simplified calculation methodology or by following a traditional inventory calculation eg.

How to Calculate Ending Work in Progress. An accounting procedure for estimating the value of a stores merchandise. The ending inventory valuation would be 175 while the cost of goods sold for the month would be.

You can print a report for supply and demand information using this criteria. The risk even increases if the business operates in the manufacturing sector. KY FILE Kentucky also offers another option for filing your state return electronically free of charge.

Make sure to turn the slider boxes for Automatic addition of Inventory transactions as well as Post product receipt in. This number is required to determine the cost of goods sold COGS and the ending inventory balance. Work in the process represents partially completed goods or in other terms these goods refer to be goods in process.

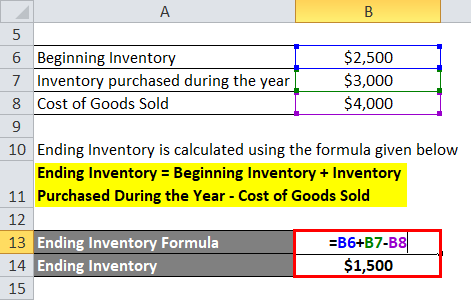

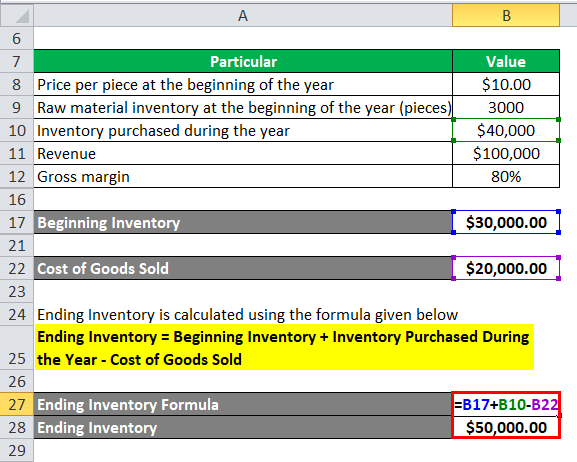

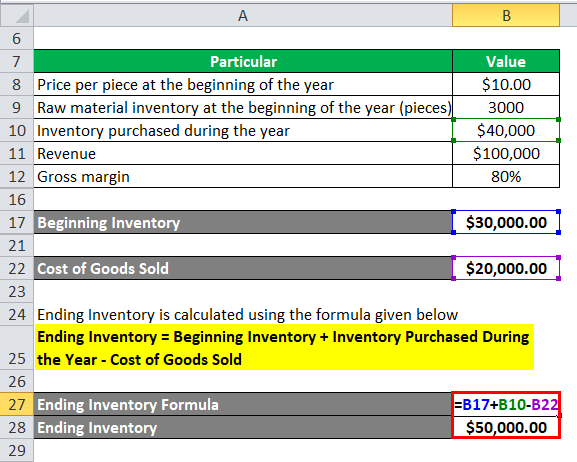

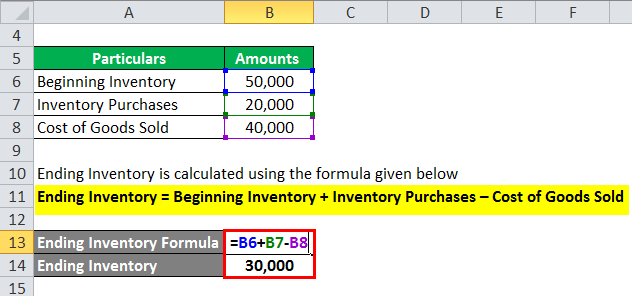

Determine the cost of purchases of raw materials that were made during the period taking into account freight in trade and cash discounts. Determine the ending inventory balance. Ending inventory is the amount of the beginning inventory plus or minus the amount of the item ledger.

Work in process WIP is inventory that has been partially completed but which requires additional processing before it can be classified as finished goods inventory. Heres a quick guide to inventory accounting methods and how they work. Using FIFO Ending Inventory Formula.

For a short period work in the process is also considered a product moving to the finished product from raw. A shoe retailer has an initial inventory amount of 8000 with a total purchase amount of 8000. The real cost of these unfinished goods can vary for.

Many taxpayers may need to maintain a separate inventory calculation to include these negative adjustments as Sec. The cost of goods sold includes not only the products in your inventory for sale but also the labor to produce and ship them as well as the parts and materials. Therefore we leave the oldest units for ending inventory.

Work in process inventory AKA work in progress or WIP inventory is everything that happens to inventory in between raw materials and finished goods. Work in Progress Inventory vs. Specify the lots to be included in the calculation of on-hand inventory.

Its been moved out of its initial warehousing environment and is now a work in progress. By using the above-given data do the calculation using all three methods. Manufacturing companies have three types of inventory.

1000 units x 8 8000. FIFO first in first out inventory management seeks to value inventory so the business is less likely to lose money when products expire or become obsolete. A value measurement for.

The reason is that business operating in manufacturing segment is expected to have a greater quantity of raw material work in process and the finished goods. This is when the. Determine the cost of goods sold from your annual income statement.

This means that the company may need to reduce the cost of goods by 500 to make up for extra inventory in their financial accounts. At that point the inventory is no longer raw. Ending Inventory per LIFO.

The amount of ending work in process must be derived as part of the period-end closing process and is also useful for tracking the volume of production activity. Work In Process Inventory. Days inventory outstanding formula.

This method calculates a stores total inventory value by taking the total retail value of the. First go to Inventory Management in the Finance and Operations moduleMoreover select Setup followed by Inventory and warehouse management parameters. Standard costs burden rate etc.

Remember that the last units in the newest ones are sold first. A companys ending inventory should be included on its balance sheet and is especially important when reporting financial information to seek financing. Identify the beginning inventory of raw materials then work in process and finished goods based on the prior years ending inventory amounts.

Work in process WIP. Calculation difficulties equivalent units. It is possible to estimate the amount of ending work in progress though the result can be inaccurate due to variations caused by actual scrap levels rework and.

Cost Of Goods Manufactured Formula Examples With Excel Template

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

How To Calculate Ending Inventory The Complete Guide Unleashed Software

Manufacturing Account Format Double Entry Bookkeeping

Ending Inventory Formula Calculator Excel Template

Work In Progress Wip What Is It

How To Calculate Finished Goods Inventory

Cost Of Goods Manufactured Formula Examples With Excel Template

Inventory Formula Inventory Calculator Excel Template

Work In Progress Wip Definition Example Finance Strategists

Wip Inventory Definition Examples Of Work In Progress Inventory

Work In Progress Wip What Is It

Cost Of Goods Sold And The Income Statement For Manufacturing Companies Accounting In Focus

Finished Goods Inventory How To Calculate Finished Goods Inventory

Work In Process Wip Inventory Youtube

All You Need To Know About Wip Inventory

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com